Modern Portfolio Theory

The fundamental axiom of modern portfolio theory is that risk and return are related. Investment strategy is defined as the science of capturing the maximum return at a stated level of risk. The asset class of value stocks represents a distinctive risk for which we expect compensation. When the risk and return characteristics of value stocks are blended with other asset classes, the result is a diversification benefit. Therefore, including value stocks in a broadly diversified portfolio is expected to increase return while reducing risk.

Value Stocks vs. Growth Stocks

To understand this strategy fully, we must first understand the difference between a value stock and a growth stock. Growth stocks are generally better companies. They have earnings growth. They have exciting products. They are well respected. Value companies are generally inferior companies. They have stagnant earnings. They may have management problems. They are out of favor. Wal-Mart is an example of a growth company and Kmart is an example of a value company. There is no doubt that Wal-Mart is a better company than Kmart. It is better than Kmart in virtually every statistical category imaginable.

The fact that Wal-Mart is a better company than Kmart does not necessarily mean that it is a better investment. As an example using hypothetical data, there are 4.5 billion shares of Wal-Mart stock outstanding. At $50 per share you would pay $225 billion to buy the entire company. There are 480 million shares of Kmart stock outstanding. At $6 per share you would pay less than $3 billion to buy the entire company. That means that Wal-Mart is almost 80 times as expensive as Kmart.

There is no argument that Wal-Mart is a better company than Kmart. The question is whether it is worth 80 times more. It may be; we do not know. What we do know is that historically value companies have produced higher returns given a long enough time period.

Why Do Value Stocks Produce a Better Return?

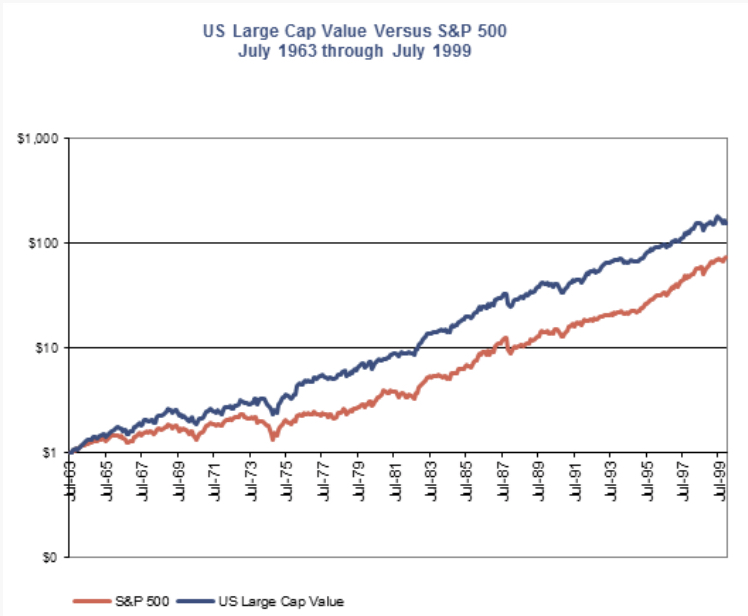

The claim that value stocks produce higher returns than growth stocks over time has been borne out by many studies. These studies objectively identify value stocks in slightly different ways, all of which are valid. Some studies advocate stocks with low P/E (price to earnings) ratios. Other studies advocate buying stocks with high ratios of book value to market value. Still others advocate buying stocks with high dividend rates. These are all different methods of identifying value stocks. All produce similar results when applied consistently over long periods of time.

Professors Gene Fama (University of Chicago) and Ken French (MIT) have produced some of the best known research. Gene Fama’s work on the efficient-market hypothesis was part of his Ph.D. thesis in 1964 and is now widely accepted in academia. Additional research showed that small cap and value stocks produced higher than expected returns. Fama and French determined that these higher returns simply represented compensation for additional risk factors. They then expanded the capital asset pricing model (a one-factor model) to include these new risk factors. The new model is called “The Three Factor Model”.

They identify value stocks by comparing book value to market value. Book value is what the accountants say a company is worth. A stock with a high “Book to Market” (BtM) ratio is a value stock. In our Wal-Mart – Kmart example Wal-Mart has a high price and thus a low BtM ratio while Kmart has a low price and thus a high BtM. Fama and French grouped stocks by their BtM ratio and found that companies with a high BtM ratio had higher returns than stocks with a low BtM ratio.

The fundamental reason high BtM stocks have a higher return is that they are more risky. Academically, expected return is a company’s cost of capital. Just like a higher risk company pays a higher interest rate to borrow from a bank, their stock must pay investors a higher return to entice them to invest. In equilibrium, a stock’s price is determined by creating an expected rate of return at which the demand for capital equals the supply of capital. Investors will only invest in a more risky stock if they believe they will enjoy a higher return. Just like stocks produce higher returns than bonds because they are more risky. The greater the risk, the greater the expected rate of return. Companies with a high BtM ratio are often in financial distress or out of favor. They are riskier than growth stocks and therefore their market value is lower. Or, to flip it around, value stocks are sold at a discount. Growth stocks, on the other hand, are in favor and their market value reflects an optimistic outlook. They are sold at a premium.

Harnessing the Value of Value

We must next determine the best way to capture the return available in value stocks. Broadly speaking, there are two approaches. We can sort through all the value stocks and attempt to identify and purchase only the good ones (active management). This method is subjective and the criteria are constantly shifting. Alternatively, we can buy all the value stocks using objective criteria (passive management).

Some active managers will capture more than their fair share of the expected value stock return. Others will capture less. Before costs, the aggregate result of active managers will exactly equal the average for the asset class. This must be so since, in the aggregate, all stocks are owned and the aggregate is the average. However, after incurring the higher cost of their approach (commissions, trading costs and management fees), most active managers will produce worse results than the average for the asset class.

This means that the average passive investor will produce superior results simply because they do not incur commissions and their trading costs and management fees are significantly less. These costs are so much less that the passive investor will beat three-quarters of active managers on a before-tax basis. Since passive management is also more tax-efficient, the advantage is even greater after-tax.

Moreover, passive investing is the only way to ensure that the expected return from investing in value stocks will be realized. Active managers can never be sure they will capture the expected return from value investing. Every attempt to generate a higher return carries an equal and opposite risk of generating a lower return. In addition, active managers tend to look for the “good ones”. In value investing, the search for “good ones” leads us to the less “valuish”. Remember value companies are inferior companies. It is their inferiority that causes them to have a higher cost of capital and thus a higher return expectation.

Passive management is reliable. Using objective criteria guarantees that the asset class on which the research has been based will be captured.

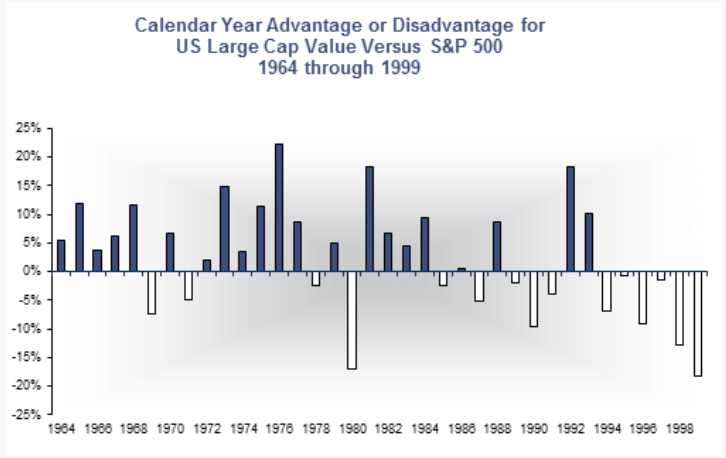

How Much Value is Enough?

Because value stocks are expected to produce higher returns over time it is tempting to exclude all other stocks. There is some merit in doing so but you must have a high tolerance for risk and a long-time horizon. It is almost certain that over the next thirty years value stocks will produce higher returns than growth stocks. Over shorter periods, it is also expected that value stocks will produce higher returns, but the probability is much lower. Over the past five years, for example, value stocks have produced significantly lower returns than growth stocks. In the year 2000, value stocks produced better results.

For most investors, it is more prudent to keep a mix of value and growth stocks. More aggressive investors may wish to heavily overweight value, but in doing so take the risk that there may be long periods of time during which value stocks underperform growth stocks. In our portfolios we advocate a tilt toward value, but we do not advocate an extreme tilt for any but the most aggressive investors.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. Indices are not available for direct investment; therefore their performance does not reflect the expenses associated with the management of an actual portfolio. The index returns above assume reinvestment of all distributions. This information is for educational purposes only and should not be considered investment advice or an offer of any security for sale.

Resource Consulting Group is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC, member FINRA and SIPC. Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC. All information referenced herein is from sources believed to be reliable. Resource Consulting Group and Hightower Advisors, LLC have not independently verified the accuracy or completeness of the information contained in this document. Resource Consulting Group and Hightower Advisors, LLC or any of its affiliates make no representations or warranties, express or implied, as to the accuracy or completeness of the information or for statements or errors or omissions, or results obtained from the use of this information. Resource Consulting Group and Hightower Advisors, LLC or any of its affiliates assume no liability for any action made or taken in reliance on or relating in any way to the information. This document and the materials contained herein were created for informational purposes only; the opinions expressed are solely those of the author(s), and do not represent those of Hightower Advisors, LLC or any of its affiliates. Resource Consulting Group and Hightower Advisors, LLC or any of its affiliates do not provide tax or legal advice. This material was not intended or written to be used or presented to any entity as tax or legal advice. Clients are urged to consult their tax and/or legal advisor for related questions.