Lowering expenses is one investment strategy that is mathematically geared to increase returns. When Bill Sharpe, winner of the Nobel Prize in economics for his Capital Asset Pricing Model, was asked what single factor he would look at first in selecting a mutual fund, he responded, “Expenses”. The relevance of all other mutual fund statistics is subject to debate.

The Impact of Expense Ratios

Actively managed mutual funds operate with the belief that they can either pick stocks and/or time the market. The average expense ratios run from 1.16% for no-load mutual funds to 2.18% for back-end loaded mutual funds. Contrast these ratios with the average no-load index fund, which has an expense ratio of 0.47%. The impact of these costs is easily demonstrated by assuming $100,000 invested for thirty years in three hypothetical funds with identical gross returns of 11% and expense ratios matching the averages below: Those differences could easily make or break a retirement goal!

The Impact of Indirect Expenses

The expense ratio is a direct expense. A mutual fund is required to disclose its expense ratio so investors can make comparisons. But there are other expenses incurred by mutual funds that are not so obvious. It is not unusual for actively managed mutual funds to spend 3% per year on transaction fees and commissions. In contrast, transaction fees on passively managed funds are commonly less than 0.05% per year.

Active Managers Can Affect the Market

There is yet another hidden cost of actively managed mutual funds. These funds often trade in enough volume to move the market. The movement may be trending in an undesirable direction. Sellers

push the price down causing a lower sales price on the stocks they are selling. Buyers push the price up causing a higher purchase price on the stocks they are buying. This increases the effective cost of trading to more than just the commissions. This effect is usually minimal in large cap U.S. common stocks, but can be significant in small cap stocks and can be huge in emerging market stocks.

Everyone’s Favorite Cost – Income Taxes

But wait, there’s more! Don’t forget about income taxes. A fund with a 300+% turnover ratio will distribute large portions of earnings in the form of ordinary income and capital gains. Such a high turnover will generate a significant amount of ordinary income. The fund is required by the income tax laws to distribute that income to its investors either in cash or reinvested shares. The tax impact on a taxpayer in the highest tax bracket can easily represent a 3% reduction of the fund’s return. Contrast this with the Vanguard S&P 500 index fund, which in 1999 had only a 6% turnover ratio. Its tax impact reduced the return by less than one-half of one percent.

Aggregate Costs Can Really Add Up

The aggregate of all these costs (expense ratios, transaction fees, commissions, market movement and taxes) is often above 6%, sometimes significantly more. Of course, all of these costs are incurred in the hope of earning above average returns. There is no doubt that some funds will be successful in spite of high costs.

Why should you worry about costs when the return is higher net of these costs? In hindsight, isn’t it only the net return that matters? Looking forward, we must consider the probability of repeating the past. Will high return funds generally maintain high returns? They will most certainly continue to have high costs. However, evidence suggests their returns will become average.

High Costs Create Increased Risk

Actively managed funds must take more risk just to equal the market. For example, a mutual fund with aggregate expenses of 5% must beat the market by 5% just to break even. To be ahead of the market by 2%, the fund must beat the market by 7%. Active managers believe this can be done by picking stocks and/or timing the market. Most are unsuccessful and those that are successful enjoy that success at a higher level of risk.

Searching for the Answer

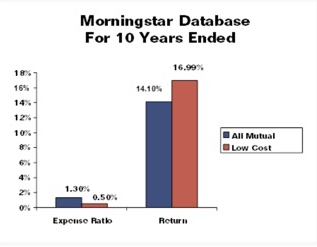

The historical statistics needed to properly compare active mutual funds to index funds are hard to come by because of “survivorship bias”. In a magic trick increasingly popular, lagging mutual funds disappear like Houdini. According to a May 10, 1999 article in The Wall Street Journal, there is an increasing tendency to bury the record of an under-performing fund and to merge it into a better-performing one. Despite this limitation, in 1994, Professor Mark Carhart of the University of Southern California concluded from a study of 32 years of data that, “There is no evidence that skilled active fund managers exist.” If skilled active managers do not exist, why incur costs and risks in support of their activities? Whether the costs are direct management costs or indirect costs makes no difference. For the 10 years ended December 1998, the average mutual fund in the Morningstar database returned 14.10% and currently has an expense ratio of 1.30%. Contrast that average with funds having a current expense ratio of less than 0.5% and a return of 16.99%.

This 2.89% return advantage seems to be dramatic evidence that low cost investing works. However this 2.89% return advantage is not completely due to cost savings. The median market cap of the high and low cost funds is $52.2 billion and $26.6 billion, respectively. During this time period larger companies produced higher returns. Therefore it is difficult to say how much of the 2.89% return advantage is due to cost savings. On the other side, however, many of the poor performing high cost funds no longer exist. Therefore, it is possible that the actual advantage of low cost investing is more than 2.89% per year.

There is so much data about investing and mutual funds that it is possible to present data that seems to support any conclusion desired. Long discussions like this do not sell magazines and do not sell mutual funds.

Conclusion

It is worth counting the pennies when it comes to investment costs.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. Indices are not available for direct investment; therefore their performance does not reflect the expenses associated with the management of an actual portfolio. The index returns above assume reinvestment of all distributions. This information is for educational purposes only and should not be considered investment advice or an offer of any security for sale.

Resource Consulting Group is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC, member FINRA and SIPC. Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC. All information referenced herein is from sources believed to be reliable. Resource Consulting Group and Hightower Advisors, LLC have not independently verified the accuracy or completeness of the information contained in this document. Resource Consulting Group and Hightower Advisors, LLC or any of its affiliates make no representations or warranties, express or implied, as to the accuracy or completeness of the information or for statements or errors or omissions, or results obtained from the use of this information. Resource Consulting Group and Hightower Advisors, LLC or any of its affiliates assume no liability for any action made or taken in reliance on or relating in any way to the information. This document and the materials contained herein were created for informational purposes only; the opinions expressed are solely those of the author(s), and do not represent those of Hightower Advisors, LLC or any of its affiliates. Resource Consulting Group and Hightower Advisors, LLC or any of its affiliates do not provide tax or legal advice. This material was not intended or written to be used or presented to any entity as tax or legal advice. Clients are urged to consult their tax and/or legal advisor for related questions.